The Indian Auto Components Industry: A Long-Term Bet!

THE INDIAN AUTO COMPONENTS INDUSTRY OVERVIEW

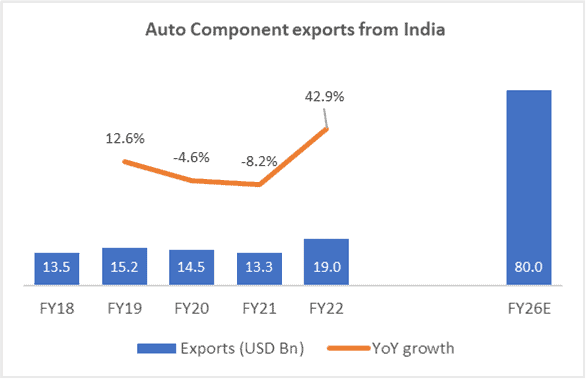

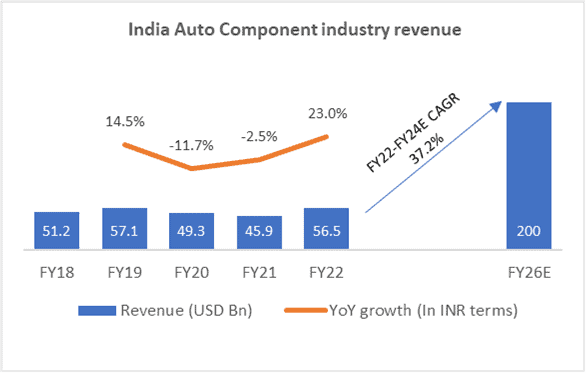

The Indian auto components industry had a turnover of USD 56.5 bn in FY22 and contributed to 2.3% of India’s GDP. As per Automobile Component Manufacturers Association (ACMA), the Indian auto component industry aims to achieve USD 200 bn in revenue by 2026 which is almost 4-fold growth from FY22 levels (37.2% CAGR between FY22-FY26E). India is expected to become globally the 3rd largest auto component manufacturer by 2025E and contribute 5.0% to 7.0% of India’s GDP by 2026E.

Let’s look at the key tailwinds that will lead the Indian auto components industry into becoming an attractive global manufacturing hub.

Government Incentives Are Encouraging For The Indian Auto Components Industry

The Government has introduced several initiatives for the development of the auto and auto components industry and to encourage manufacturers to Make-in-India. The government has adopted an enabling approach toward making India a global manufacturing hub. A few of the schemes initiated over the last 2 years include:

- The Union Cabinet announced the Production-Linked Incentive (PLI) Scheme in the Automobile and Auto Components sectors with an outlay of INR 259 bn to boost domestic manufacturing of advanced automotive technology products and attract investments in the automotive manufacturing value chain. A total of 95 applicants have been approved under this PLI scheme. The Government is providing financial support from 8.0% to 13.0% of the sales value of specified components for auto component makers. The PLI scheme promotes domestic manufacturing and less reliance on imports.

- The Government approved a PLI scheme with an outlay of INR 760 bn for semiconductor manufacturing. It is a comprehensive program for developing the semiconductors and display manufacturing ecosystem in India.

- To encourage the manufacturing of EV batteries in India, a PLI scheme of INR 181 bn was introduced for Advanced Chemistry Cell (ACC) battery storage, with an aim to achieve a manufacturing capacity of 50 GWh of ACC. Four companies (Rajesh Exports, Hyundai Global Motors Company, Ola Electric Mobility, and Reliance New Energy) were selected as beneficiaries. Excluding Hyundai Global Motors Company, the other 3 selected companies signed the Program Agreement in July 2022. The objective of the Government is to improve domestic value addition and ensure cost competitiveness of Indian-manufactured batteries.

The Government extended the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme till 2024 to promote electric mobility. The scheme is designed to support the electrification of public and shared transport and develop a charging infrastructure.

‘China Plus One’ Strategy Of Global Automotive Players To Help India Auto Components Players

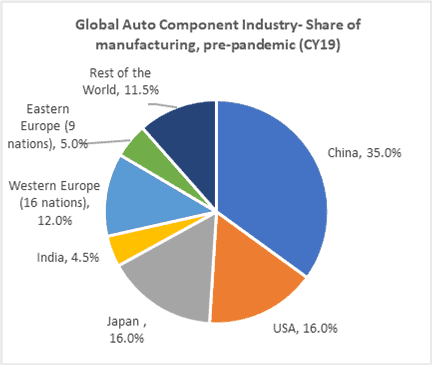

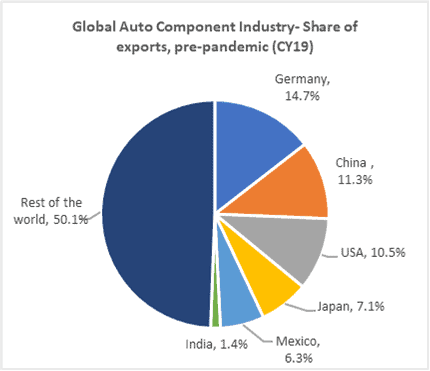

As per the last available data from the pre-pandemic period of CY19, China contributed a 35.0% share of global auto component manufacturing and an 11.3% share of global auto component exports. The global automotive supply chain faced tremendous disruptions in the last 2 years due to the COVID-19 pandemic-led restrictions. The uncertainties have further extended due to geo-political issues. This has brought the need for supply chain diversification into the limelight.