Is The Indian Debt Market Dented With Credit, Interest, Liquidity Risk, And A Looming Default Risk?

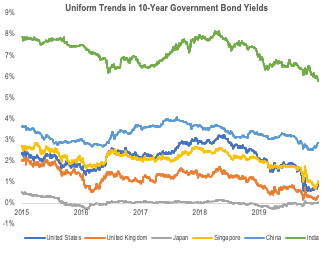

With the rise in the Covid-19 pandemic, a dramatic impact has been observed on the global economy and financial markets. To keep running the financial system, several central banks around the globe have dropped the interest rates to nearly zero. The interest rate in the US is in the range of 0% to 0.25%, in the UK it is 0.1%, in India it’s 4% while Japan which already adopted a negative rate of 0.1% in 2016 yet remains unchanged. To support the economy and the industry, various governments have eased their fiscal policies and even initiated quick measures to provide the much-required financial support which amounts to about $9 trillion according to IMF as of April 2020. This article tries to highlight some of the key recent developments in the Indian debt market and tries to identify current and potential risks.

The benchmark Indian 10-year government bond dropped to around 6% in the first week of March and stands at 5.87% on 10 June 2020, lowest in the last five years. This drop was triggered due to the global sell-off in emerging markets and the concerns of widening fiscal deficit in India. The AAA-rated PSU as well as Private Sector Bonds observed a huge sell-off resulting in the yields to rise by about 100 to 150 basis points.

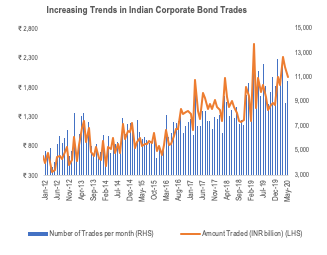

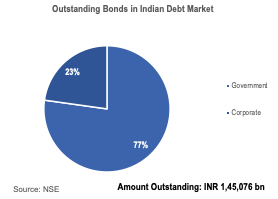

The number of trades in corporate bonds have more than doubled in the span of the last ten years from INR 397 bn (3,165 trades) in April 2011 to INR 2,145 bn (8,926 trades) in April 2020. The debt market in India yet remains underdeveloped with government debt at ~68.62% of GDP. The government debt to GDP ratio for the US, UK, and Japan is 107%, 80.7%, and 238%, respectively. The value of sovereign securities held by global funds have dropped to INR 767 billion due to the steep hedging costs for foreign currency risk incurred which has led to a deterioration in returns.

Recent Highlights Of The Indian Debt Market

- Liquidity in the debt market forces Franklin Templeton to freeze its six debt schemes, triggering the liquidity crisis in the debt market

- The three-pronged strategy (OMO, rate cuts, and economic relief package) is expected to pump the necessary liquidity in the financial market

- Amendments to the Insolvency and Bankruptcy Code (IBC) offer a good window for genuine distressed assets, however, leaves the creditors with a long impending uncertainty

- Launch of the Request for Quote (RFQ) platform is expected to bring depth, liquidity as well as transparency in the bond markets

Liquidity Risks In The Debt Market Forces Franklin Templeton To Freeze Six Of Its Debt Schemes

Fear of poor liquidity flew through the corporate debt market when Franklin Templeton informed its investors of winding up its six debt schemes. According to a press release by Franklin Templeton, the combined assets under management (AUM) of these six debt fund schemes stood at about INR 25,648 crores as on 23 April 2020. These schemes represent less than 1.4% of the Indian Mutual Fund Industry AUM as on 31 March 2020. The decision to wind up was taken to protect the interest of investors through a managed sale of the portfolio and was limited to funds that had direct exposure to higher-yielding, lower-rated credit securities in India which had been most impacted by the ongoing liquidity crisis in the market. The extreme drop in liquidity in debt markets along with large redemptions due to the Covid-19 outbreak compelled the fund house to take such a drastic measure. This announcement led to a spike in yields on bonds rated AA and below. Vedanta Ltd, Uttar Pradesh Power Corporation’s Bond, and Shriram Finance Corporation were among the top holdings of these schemes. Franklin Templeton was the sole lender to about one-third of the bonds, the issue of credit and liquidity risk does not just pertain to this fund portfolio alone, however, it is a result of the market-wide fear and slowdown.

The Three-Pronged Strategy (OMO, Rate Cuts, And Economic Relief Package) Is Expected To Pump The Necessary Liquidity In The Financial Market

The Indian government is trying to counter the coronavirus outbreak and the resulting slowdown, by announcing certain measures and policy changes, so as to bring the growth back on track, while the inflation remains within the targeted zone of 2% to 6%. Retail inflation for India stood at 5.8% during March 2020 with a 0.8% drop from 6.6% during February 2020. The Wholesale Price Index (WPI) for India stands at 122.2 for the month of February 2020 according to the RBI bulletin June 2020 after a rise of 2.26% YoY from 119.5 during February 2019.

The following key measures have been announced by the government:

- India’s Monetary Policy Committee (MPC) has observed two emergency rate cuts to infuse liquidity. Currently, the repo rate stands at an all-time low of 4%. And, to discourage lenders from parking cash with the central bank, the RBI slashed its reverse repo rate by 115 basis points to 3.35%, during May 2020.

- There is no need for banks to set aside cash reserves for loans that are provided to small businesses or for credit so as to help the customers purchase a car or house between 31 January 2020 and 31 July 2020. CRR and LCR were reduced to 3% and 80%, respectively.

- A repo operation announced in April 2020, with the condition that out of the total funds availed by the banks, 50% should be passed on to small and mid-sized NBFCs. But this operation received a passive response as the banks stayed away due to the perception of high risk.

- RBI even conducted open market operations for purchase of bonds worth INR 10,000 crore, INR 30,000 crore and INR 15,000 crore on 20th, 24th, and 26th March, respectively.

- On 30 March 2020, RBI hiked the limit for foreign portfolio investors’ (FPI) investment in corporate bonds to 15% of outstanding stock for FY2020-21. During FY2019-20, the limit for FPI in Central Government securities (G-secs), State Development Loans (SDLs), and corporate bonds stood at 6%, 2%, and 9% of outstanding stocks of securities, respectively.

- An economic package of INR 20 lakh crore was announced in May 2020 by the Finance Minister, Nirmala Sitharaman, in a set of five tranches. Under the package, a total of INR 5.94 lakh crores of relief was provided with a major focus on micro, small and medium enterprises sector (MSMEs). The government has proposed collateral-free and fully guaranteed loans which would have a moratorium period of twelve months, capped interest rate, and no guarantee fee.

- All MSMEs which have an outstanding credit of INR 25 crore and a turnover of INR 100 crore would be eligible to borrow up to 20% of their outstanding debt as on 29 February 2020. Such loans would have a tenure of four years and can be availed until 31 October 2020. A budget of INR 3 lakh crores has been allocated for this scheme.

- During a press conference dated 22 May 2020, the previously announced debt moratorium period on loan EMI installments by RBI for a period of three months ending 31 May 2020 has been extended for an additional period of three months, ending 31 August 2020. RBI also further clarified that there would be no alterations in terms and conditions of the loan agreement. The extension has been taken in view of the extension of the lockdown as well as perpetual disruptions arising due to Covid-19. Any default in loan repayment under normal circumstances would adversely affect the borrower’s credit history and risk classification of the loan. In the case of the moratorium though, the borrower’s credit score/ rating will not be impacted. The moratorium extension would lead the total liquidity cycle to extend because of delays in the collection and recovery procedure.

Amendments To The Insolvency And Bankruptcy Code (IBC) Offer A Good Window For The Genuine Distressed Assets, However, Leaves The Creditors With A Long Impending Uncertainty

The initiation of fresh insolvency proceedings has been suspended by the Government of India for a period of the next six months to safeguard the companies which have been negatively impacted by Covid-19. The government can extend this suspension for up to one year, as per the ordinance dated 5 June 2020. The ordinance suspends Section 7, 9, and 10 of the IBC 2016, to protect weaker businesses going into bankruptcy due to this pandemic; and also offer more time and facilitate optimal solutions to distressed companies. In March 2020, the Finance Minister in her economic relief package had already hiked the threshold amount to invoke proceedings from INR 1 lakh to INR 1 crore. Any defaults that occurred before 25 March 2020 may be resolved through IBC. The suspension of six months would almost run parallel to the loan moratorium of six months from 1 March 2020 to 31 August 2020.

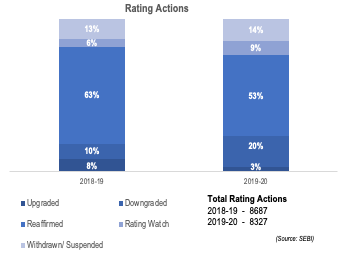

The amendments to the IBC are very timely when Indian corporate debt (maturity of 1+ year) is facing a huge spike of 89% YoY in the number of downgrades which indicates the deterioration in operations and looming probability of default by corporates.

The impact of suspension would be mostly felt by operational creditors to whom the RBI moratorium has not been granted which include debenture, bondholders, or those to whom receivables have been sold, etc. Voluntary filing by corporate debtors to restructure debt as well as filing against corporate debtors by operational creditors would be curtailed by the suspension.

Launch Of The Request For Quote (RFQ) Platform Is Expected To Bring Depth, Liquidity As Well As Transparency In The Bond Markets

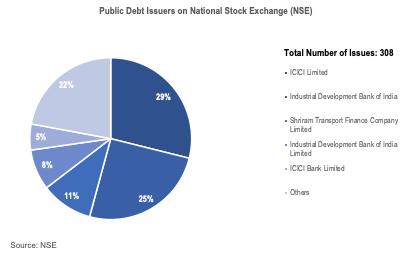

On 4 February 2020, the National Stock Exchange (NSE) launched a Request for Quote (RFQ) platform to enable the execution and settlement of trades which facilitates market participants to conduct transactions in debt securities also bring more accurate price discovery of debt securities. This platform is expected to bring the required depth, liquidity as well as transparency in the bond markets. Government securities, municipal debt securities, securitized debt instruments, and corporate bonds are the eligible securities under this platform. By leveraging this RFQ platform, market participants can request quotes from several participants concurrently and conduct transactions effectively. The finer price discovery will attract more investors in the debt market, thus increasing the liquidity.

Appendix:

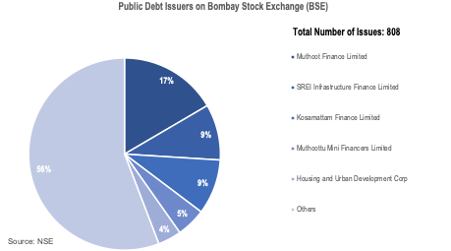

Following are top 5 Retail Traded Issuers by volume traded on Bombay Stock Exchange (BSE) for 12 months ended June 10, 2020:

| Issuer Name | Total Trade Volume | Total Trade Turnover (INR mn) |

| Zee Entertainment Enterprises Limited | 52,29,01,465 | 2,471.99 |

| Britannia Industries Limited | 13,49,17,004 | 4,153.18 |

| Nippon India ETF Liquid Bees | 3,40,43,394 | 34,043.47 |

| Kotak Mahindra Bank Ltd | 1,95,00,100 | 99.70 |

| Aye Finance Private Limited | 1,00,00,000 | 10.12 |

Source: Bloomberg

Thank you!