Is SPAC Emerging As An Alternate Option For Conventional IPOs And Private Equities In The US?

SPAC is the preferred exit option for Private Equity firms (PEs)

The SPAC was invented in the early 1990s prior to which it was referred to as ‘blank check company’. These companies faced a scandal mainly owing to fraud in penny stocks that involved manipulation of the market price for the benefit of the stock’s promoters. The SPAC was then restructured with new restrictions, one of which was the creation of an escrow account, imposed by the SEC in 1992. Further SEC not only stepped in to set a fixed price for each IPO but also regulated the voting and redemption rights for the benefit of all parties involved. In 1990s, only one SPAC IPO was completed with a deal value of $9mn, in the US. The 2000s observed ~181 SPAC IPOs with a total deal value of ~$25mn in the US, according to Bloomberg.

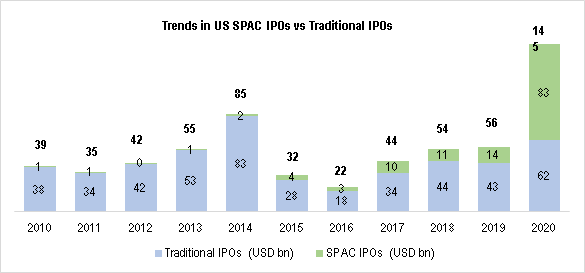

The outbreak of COVID-19 has spread uncertainty around the market in 2020. The private companies aren’t so sure with regards to raising large capital from PEs or Venture Capital firms (VCs). Another option that some private companies had was to go public through the traditional IPO route. However, the looming uncertainty, raised concerns over fair valuation and the subscription. The relative longer timeline to get publicly listed was another reason that certain private companies opted out of the traditional IPO route and looked for other alternatives.

According to MarketWatch, while the count of listed companies has dropped from 8,000 in the 1990s to about 6,000 in 2020, it is alarming to observe that the performance of the US market has consistently shown an increasing trend. Asset Under Management (AUM) of PE firms, which had an increasing trend in the past few years, stood at about $4.5tn at the end of FY2019, according to Deloitte however there has been a decline in the number of exits. Such PEs are also preferring the quicker and cheaper SPAC route as an alternate exit strategy. TPG Capital is an example of one such PE firm that is looking at SPAC route for exit and acquisitions in the past few years, according to Deloitte. There are also new SPACs being introduced in the market which specifically target PE portfolio companies. Forum Merger IV Corporation that raised $300mn in July 2020 is a SPAC with the purpose of merging with a private company. Investors have gained more confidence in SPACs after rebranding and improved regulations by SEC. According to McKinsey & Company, liquidation rates of SPACs have considerably declined while the average size of funding has grown post-2015. Prior to that year about 20% of SPACs liquidated and returned the capital to investors. The entry of more well-known participants with high-profile investors as well as recruiting executives from high-profile companies has contributed to the reputation of SPACs and has also gained the investor confidence.

SPAC Advantages: Attractive Valuations and Speedy Execution

- Certain and attractive pricing: Price negotiations are conducted during SPAC mergers which results in less uncertainty unlike the traditional IPOs which rely heavily on market timing. There is also lower chance of an IPO pop unlike traditional IPOs where investment banks that set the pricing may not always reflect true valuation of the company.

- Speedy process: Through a merger with SPAC, a private company can get listed within just 3-4 months which would otherwise take around 2-3 years in a traditional IPO process.

- Strategic partnership: SPAC sponsors are not obligated to, however may provide specialized expertise to the existing management of the company.

- No unexpected liabilities: As the SPAC does not have a business of its own, it has a clean balance sheet.

- Cost effective: SPACs generally pay for most of the costs thus saving a significant amount of money of the target company.

Monetary benefits for all the stakeholders

SPAC, being just a shell company with no business of its own, faces less regulatory requirements. Sponsors receive easy access to capital. Sponsors also receive ‘Sponsor Promote’ by which they are entitled to receive 20% of SPAC shares post-IPO for a nominal cash consideration, once the merger with a private company is complete. This Sponsor Promote is often subject to a lock-in period of 12 months after the De-spaced Company is formed. Sponsors also face low risk by investing in later-stage private companies. Both retail and institutional investors rely on the experience and expertise of the sponsors. Institutional investors receive a downside protection when investing in SPAC as they can redeem their capital, if they do not approve of the target company chosen by the sponsors. If the institutional investors approve of the target company, they receive additional profit opportunities by exercising the warrants they receive at the SPAC IPO stage. But this is only subject to target company being acquired within the regulated time frame (i.e., 24 months), otherwise the SPAC would be liquidated, and capital would be redeemed to sponsors and investors.

Certain largest Grossing from the SPAC IPOs in 2020

| SPACs | Acquired Company | Merger Completion Date | IPO Date | Gross IPO Proceeds (USD billion) |

| Pershing Square Tontine Holdings, Ltd. | TBA | TBA | 22-Jul-20 | 4.00 |

| Churchill Capital Corp IV | Lucid Motors | TBA | 30-Jul-20 | 1.80 |

| Foley Trasimene Acquisition II | Paysafe Group Holdings Limited | 30-Mar-21 | 19-Aug-20 | 1.30 |

| Social Capital Hedosophia Holdings Corp. VI | TBA | TBA | 09-Oct-20 | 1.00 |

| Churchill Capital Corp III | MultiPlan, Inc. | 08-Oct-20 | 14-Feb-20 | 1.00 |

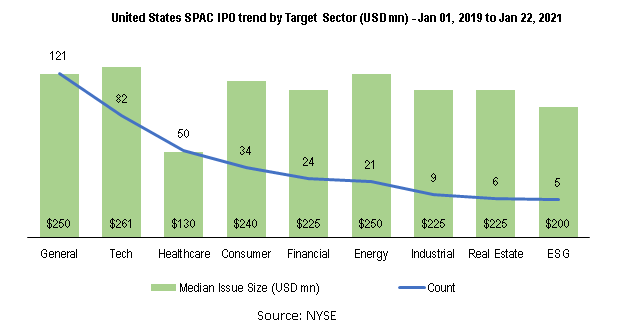

SPAC is favourite among General, Technology and Healthcare sector

SPAC sponsors are legally not bound to however may identify their target merger sector upon launch. If sponsors find a lucrative merger opportunity in the sector other than the one originally targeted, they may move forward with such an opportunity. According to NYSE data, since January 2019, it can be observed that General sector with 121 SPAC IPOs leads the table, followed by Technology with 82 and Healthcare sector with 50. In terms of SPAC median issue size, Technology sector leads with $261mn in median proceeds, followed by General sector and Energy sector with $250mn median proceeds each.

So, is SPAC the future?

SPACs have been gradually rising since the past decade but have gained significant traction in the past two years backed by their ease of issuance as well as simple and flexible structure. Recently, PEs are also preferring the quicker and cheaper SPAC route as an exit strategy. Improved regulations by SEC has instilled investor confidence in SPACs. M&A transactions are expected to rise in the upcoming years with about 429 SPACs searching for the target companies, according to SPACInsider. Investors gained around 9.3% annually during SPAC IPO phase, according to a research by the University of Florida and University of South Carolina. But further, investors in common shares lost around 4.0% to 15.6% in the first year of their mergers, depending on weighting methods. A research by Reuters also states that many SPAC deals, especially during March 2021 are trading below their IPO price of $10 per unit indicating a loss of steam. The key risks of SPAC being just a shell company, uncertainty of the target company being acquired and inaccessible capital during the span of two years have led certain investors to lose faith in SPACs, resulting in some hedge funds to short SPACs. Only time will tell the longevity of the current SPAC frenzy.

Notes and References:

Sponsor Promote: The founder shares are also known as ‘promote’. For a nominal cash consideration, sponsors receive a special class of shares to about 20% of the SPAC’s total post-IPO equity known as the sponsor promote

De-spaced Company: The business combination of SPAC and the target company acquired. A de-spacing transaction is referred to an initial business combination between SPAC and the target company.

https://www.nasdaq.com/articles/a-record-pace-for-spacs-2021-01-21

https://spacinsider.com/stats/

https://news.bloomberglaw.com/bloomberg-law-analysis/analysis-three-decades-of-ipo-deals-1990-2019

https://openscholarship.wustl.edu/cgi/viewcontent.cgi?article=1160&context=law_lawreview

https://www.jbs.cam.ac.uk/insight/2020/the-rise-of-the-special-purpose-acquisition-company/

https://www.excelsiorgp.com/resources/what-is-a-spac-and-why-are-they-suddenly-so-popular/

https://www.cbinsights.com/research/report/what-is-a-spac/

https://www.managementstudyguide.com/why-do-ipos-get-underpriced.htm

https://www.excelsiorgp.com/resources/what-is-a-spac-and-why-are-they-suddenly-so-popular/

https://forummerger.com/forum4_prospectus.pdf

https://www.sec.gov/Archives/edgar/data/1811882/000119312520197776/d930055d424b4.htm

https://www.sec.gov/Archives/edgar/data/1811210/000110465920088441/tm2020647-15_424b4.htm

https://sec.report/Document/0001104659-20-138110/tm2035926-2_s1.htm

DISCLAIMER

This document sample has been prepared by ValueAdd Research & Analytics Solutions (“ValueAdd”). This is illustrative and is designed for marketing purposes only.

This document should not be considered as investment advice or a recommendation, or an offer to sell or a solicitation to buy, or an endorsement or recommendation of any company.

The information has been compiled or arrived at from sources believed to be reliable and accurate at the time of this analysis and in good faith. ValueAdd makes no representation or warranty, express or implied as to, nor has it verified, the accuracy, completeness, correctness, and authoritativeness of the information. Accordingly, ValueAdd accepts no liability for any direct or consequential loss or damage arising from (i) the use of this communication, (ii) reliance on any information contained herein, (iii) any error, omission, or inaccuracy in any such information, or (iv) any action resulting therefrom. Authorized recipients should verify the factual accuracy, assumptions, calculations, and completeness of the information.

This document should not be reproduced in any form or distributed (in whole or in part) to any third party without the express prior written permission of ValueAdd.