Global Fixed Income Market Performance – YTD 2022

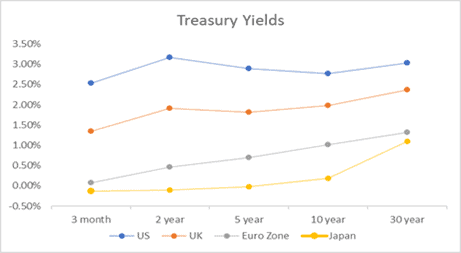

The financial conditions across global markets have significantly tightened since the central banks-initiated policy tightening to rein in the record high inflation. The US Federal Reserve has hiked the interest rates by 300 bps YTD within a target range of 3.00-3.25%. Credit spreads have widened, stock markets came crashing, the dollar strengthened, and real interest rates have started the move towards positive territory.

The tightening liquidity and rising interest rates have resulted in negative returns in developed as well as developing market, across maturities and issuer quality. Here’s a quick review of the global fixed income market performance.

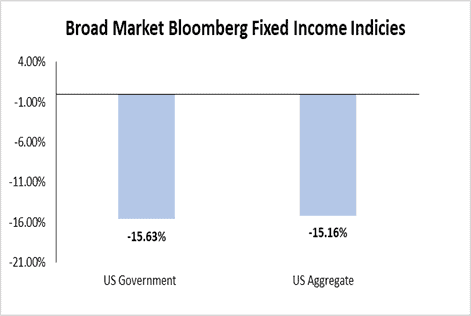

The liquidity normalisation has resulted in investors flocking to short-term US T-Bills along with a surging dollar. US Govt. and Investment grade issues haven’t been spared from negative returns YTD.

Segment Performers

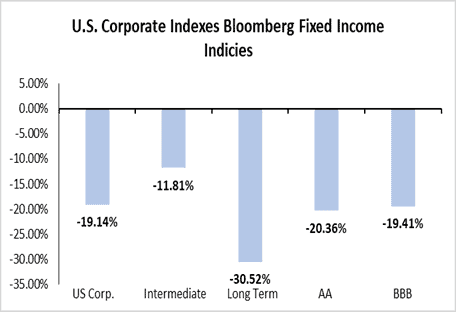

High Quality Trumps High Yield In A Volatile Market

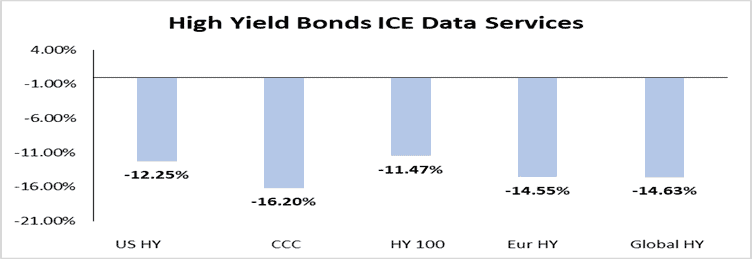

The Treasuries and high-quality investment grade securities fared relatively better than their high yield counterparts in a volatile period for bond markets in the U.S. and around the world as monetary policy shift from the global central banks battling rising inflation, combined with Russia’s invasion of Ukraine, fuelled a flight from risk. The aggressive monetary policy stance by the US Fed have accelerated investors parking their funds into safe havens like T-bonds and gold, away from volatile high yield debt.

Within this environment, interest rates witnessed upwards trajectory and credit spreads widened. The yield on the benchmark 10-year U.S. Treasury had risen to 4.02% from 1.51% at the start of the year. The spreads for investment grade have widened 104-199 bps, while spreads for high yield and CCC rated widened up to 601 bps and 1267 bps respectively.

As a bright spot, the U.S. high-yield default rate has remained largely steady at 0.80% as of Aug ’22 was well below the long-term average of 3.8%. However, Fitch expects it rise to 2.5-3.5% in 2023.

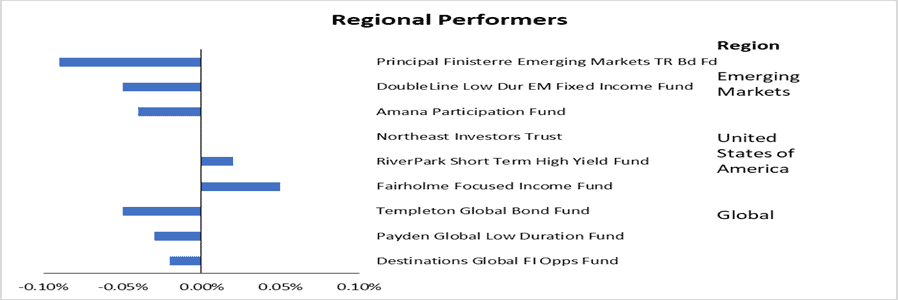

Regional Performers

Europe

German bonds and overall euro zone high yield bonds are down 14.60% and 14.55% respectively, seven- to 10-year ICE BofA indexes going back to the 1986 show. The bond sell-off has been primarily driven by the shift in central banks’ policy and in their rhetoric. Bonds of top-rated European companies were down 12.5% in the first half of the year, their biggest losses on record going back to 1997. Their high yield peers have endured their worst drop since 2008.

Emerging Market

Emerging markets assets have been under significant stress since well before the recent increase in stagflation and recession risk. The fall from the highs mirror the global financial crisis of 2008. The year has seen drawdown of 21.4% and a negative return of 20.04%.

Emerging markets central banks are well ahead of their developed markets peers in their tightening cycles, raising interest rates by nearly 200 bps. However, the real rates remain negative despite the aggressive and pro-active rate hikes.

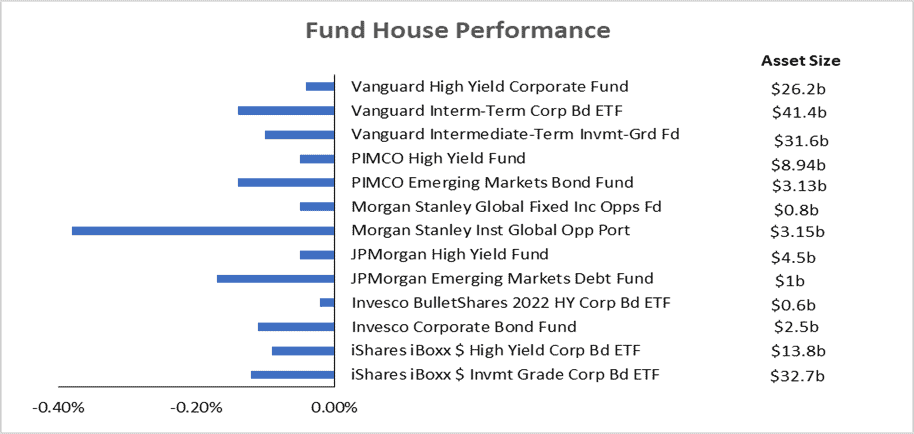

Top Performing Funds:

Financial markets in 2022 have only posted moderate returns with funds across regions and asset managers struggling to replicate the pandemic era liquidity driven rise.

A glance of some of the regional performance of funds across geographies and reputed asset managers:

Source: https://money.usnews.com/funds

Outlook:

US Federal Reserve Policy Outlook

The Fed has reiterated its stance of policy tightening “expeditiously” until inflation comes down within a comfortable range. The Fed’s target interest rate in Nov ’22 meeting is likely to be hiked to 5.00% by 2023-end and the balance sheet size cut back to pre-pandemic level of $4.3 tn by June ‘26. Reducing the size of the balance sheet combined with a synchronized global tightening cycle can mean a substantial decline in excess liquidity circulating in the global economy.

The markets have already discounted much of the lower liquidity with expectations of Fed raising target rate to 3.75% in the November meet.

Euro Zone

European bond market investors are still nursing from the record losses in the 9M FY ’22 and the market participants are pricing in lower volatility ahead.

The market outlook is slightly hazy as European Central Bank moves away from the negative interest rate period by hiking its deposit rate by 50 bps to 0.00% in July policy meet, a first hike since 2014 to tackle record inflation. ECB in its Oct meet brought its key rates in a range of between 1.5 – 2.25%. The guidance remains hazy even as the central bank fights a two-fronted battle of slowing economy and record inflation, while political uncertainty in France and Italy makes the interest rate movement predictions murky.

Emerging Economies

A key criteria of EM economies growing faster than DM economies for strong returns has not been realised with developed markets outperforming the EMs, taking advantage of the abundant liquidity and the pent-up demand.

Balance sheets for emerging market corporate issuers remain strong, although lesser than a year ago and likely to witness credit quality degradation over the next 12 months.

Despite the improved fundamentals, the widened spreads are unlikely to reverse unless strong economic growth along with fall in inflation is witnessed.

The default rates, (especially in the real estate sector China), are likely to pick up as inflationary pressures impact credit quality of the issuers. Evergrande, Country Garden Sunac, Shimao, CIFI, Zhenro are some of the large players undergoing financial stress.

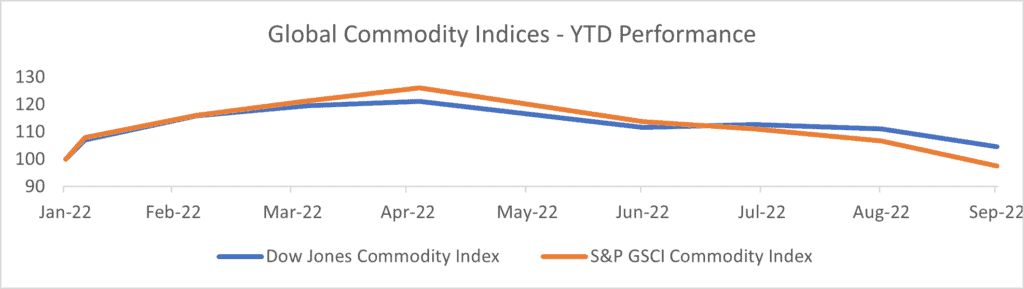

Commodity Super Cycle Cooling a Silver Lining Amid Rising Interest Rate Scenario

The commodity’s continued price rise due to supply-chain disruptions led by Covid-19 restrictions and the ongoing Ukraine-Russia conflict appear to take a breather.

Power and Fuel inflation is led by Crude Oil cooling off below $100bbl, while key manufacturing inputs of Copper and Steel are down 20.52% and 25.70% YoY respectively. The lower commodity prices are expected to help the manufacturing sector by easing their input costs.

Agricultural commodities Lumber, Palm Oil, Rubber, and Cotton are down 20.96%, 20.63%, 33.16%, and 36.32% respectively.

Lower input costs and agricultural commodities to help control overall inflation.