Global Equity Market Performance (YTD-2022)

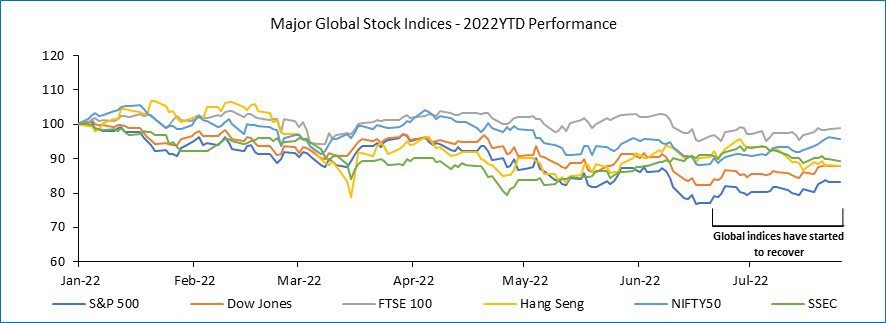

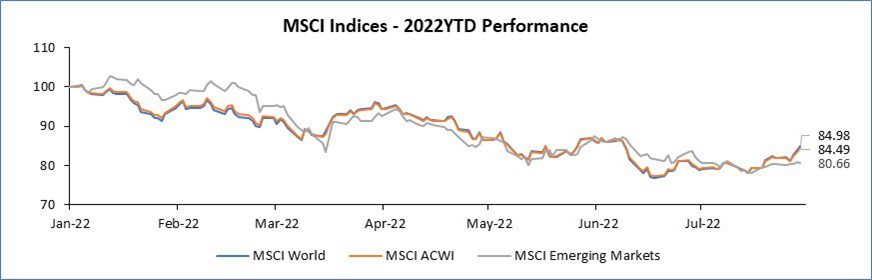

The ‘Volatility’ and ‘Bear Markets’ are the two words that aptly define the status of global equity market performance in 1H2022. Global markets have had a continuous negative run as global central banks struggled with curbing rampant inflation. Increasingly hawkish global central banks, the Russian war, China lockdowns, food and energy shortages, and growing recession fears continue to be the primary headwinds driving the risk-off price action and record low sentiment. Over £10 trillion has been wiped off the value of global stock markets in the worst start to a year on record. The MSCI ACWI Index which covers more than 2,933 constituents across 11 sectors across 23 developed and 24 emerging markets was down 21% YTD as on 30th June 2022.

A perfect storm of negative catalysts:

- Inflation: Global inflationary pressures increased in Q2 2022, following Russia’s invasion of Ukraine. Supply chain and transportation problems, as well as added volatility and rising energy, food, and commodity prices, accelerated global price growth. According to Euromonitor, under its baseline scenario, global inflation is forecasted to reach, and towards 5.0% in 2023, compared with the 2001-2019 average annual global inflation of 3.8%

- Rising Interest Rates: In a bid to fight inflation, the US Fed Reserve has already hiked the interest rates three times in 2022YTD in increasing increments of 25bps (March), 50bps (May), 75bps (June), and 75bps (July). Around 3-4 more hikes are expected in the remainder of 2022. The hikes have had a ripple effect with all central banks globally hiking rates in their respective countries. The aggressive monetary policy stance by the Fed has led to investors parking their funds into safe havens like T-bonds and gold, away from volatile equity markets

- Russia-Ukraine War: Russia’s invasion of Ukraine has led to geo-political turmoil in the European region, one of the key trade regions globally. The war has sent the markets into a frenzy with investors being thrown into a future of uncertainties

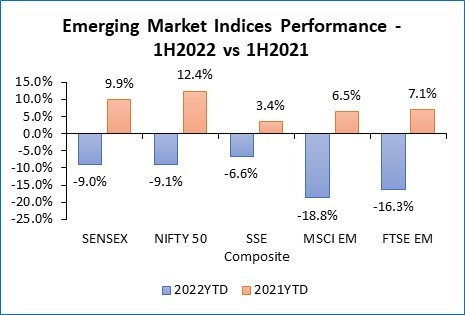

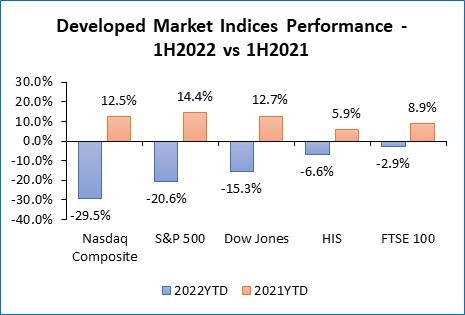

Dismal performance compared to 2021YTD:

Markets had a bullish run in 1H2021 due to the reopening of economies from lockdowns and the arrival of Covid vaccines sparked a worldwide recovery for financial markets in late 2020. However, 2022 has been painful for investors with a majority of the global benchmarks giving negative YTD returns. The S&P 500 registered its worst first half (-20%) since 1970 and its 2nd worst 1H since its inception in 1957. The Dow Jones Industrial Average suffered its biggest half-year decline since 1962. Asian stock markets too plummeted and faced their worst 1H since 2008. The stocks struggled to rebound due to global recession worries and aggressive tightening by central banks triggering heavy outflows of funds from emerging markets.

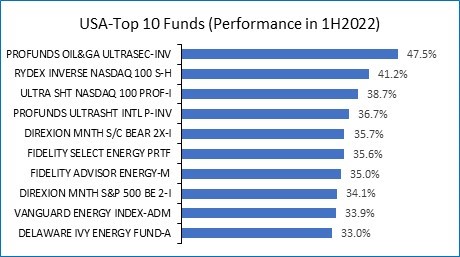

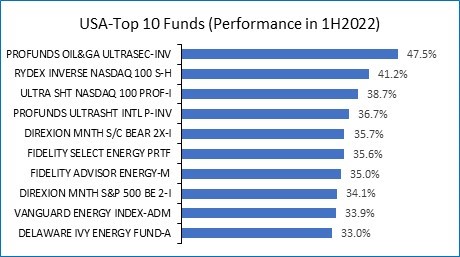

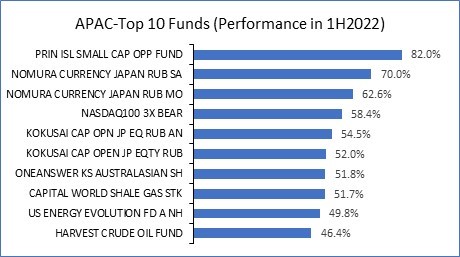

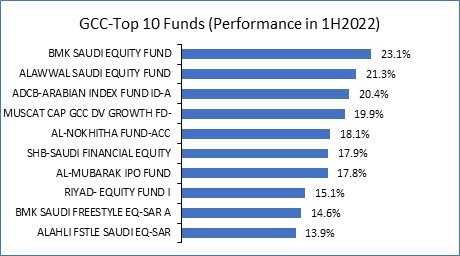

Region-wise Fund Performances:

Funds investing in oil, energy, and power stocks have given stellar 1H’22 returns. Region-wise, clearly APAC funds have been winners while GCC funds have been laggards.

Conclusion:

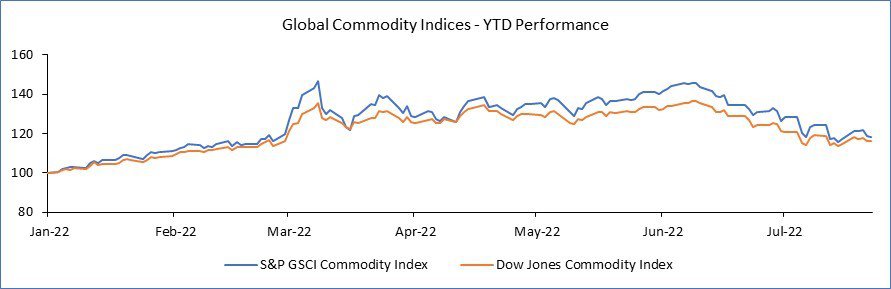

A slump in the commodity prices has sent the S&P GSCI Commodities Index back to pre-Ukraine war levels raising hopes that inflation may be fading. Oil prices have fallen to four-month lows. Copper has slumped 30% from recent highs, while wheat has fallen by 40%.

Global stock markets are unlikely to bottom out soon amid recession fears, resulting in a gloomy outlook on the global equity market performance. Over the past few months, most global central banks have tweaked their monetary policy to combat the rising inflation. Going forward, inflation concerns, geopolitical issues, and rising interest rates would keep the market sentiment in check. Current valuations look attractive relative to historical averages and the bearish sentiments allow for a rebound on positive news. Global fund managers are backing India to be best positioned among emerging nations to withstand a global recession, as a thriving domestic market makes it less dependent on exports.