ValueAdd Global Credit Monitor (June 2020)

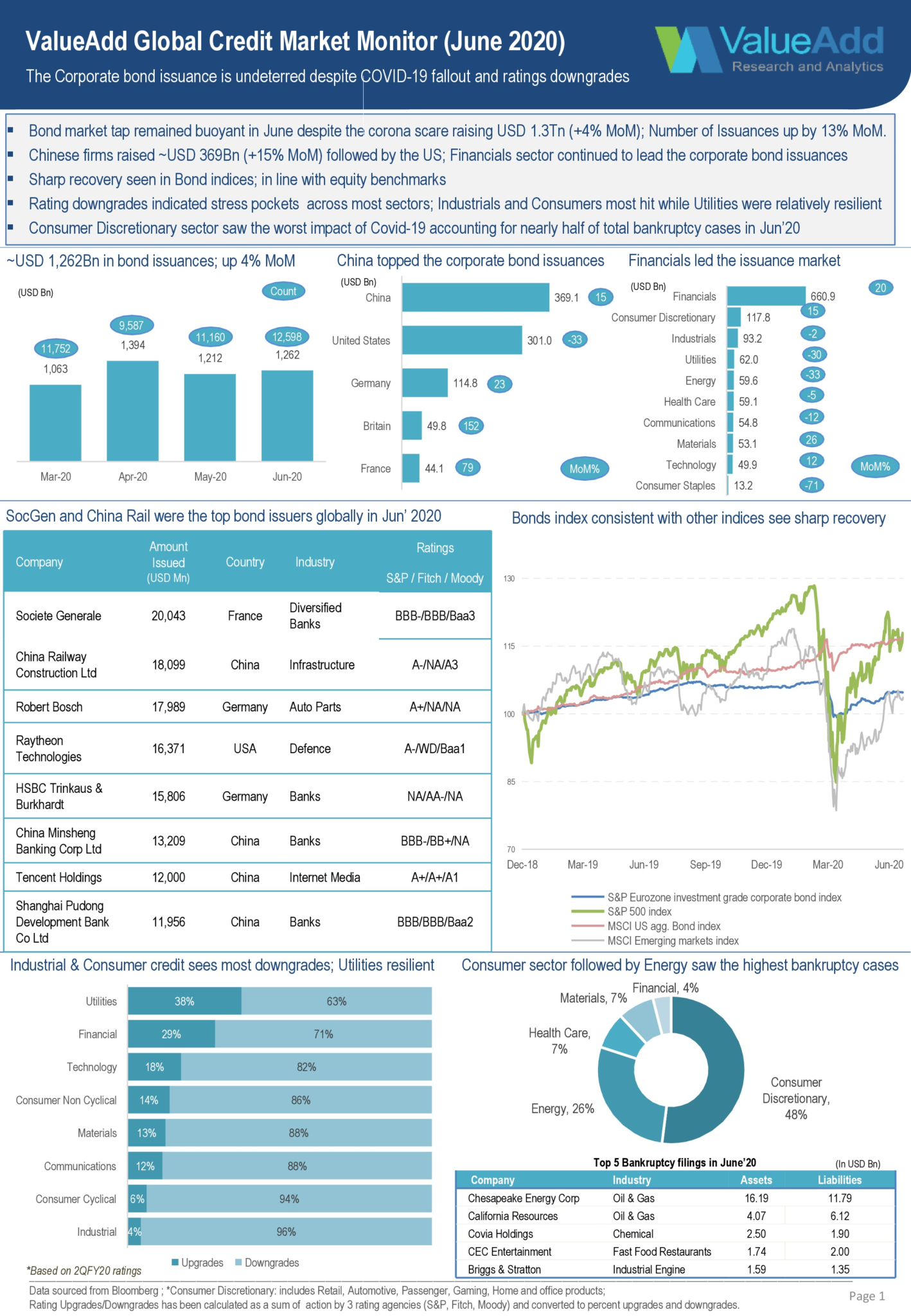

Corporate bond market activity remained buoyant in the month of June raising ~USD 1.3Tn (+4% MoM) despite the Corona scare with China-based firms dominating the issuances market followed by the US. Amongst the sectors, Financials continued to enhance their capital and liquidity position through bond placements and remained the top issuers while Consumer Discretionary which was impacted by tightening liquidity due to Corona fallout and refinancing needs for its highly leveraged balance sheet stood a distant second. Incidentally, Consumer Discretionary sector also saw the worst impact of Covid-19 accounting for nearly half of total bankruptcy incidences during the month. The rating agencies’ activities that we track clearly indicated that stress pockets continue across most sectors with Industrials and Consumers worst impacted with ratings downgrades while Utilities stood relatively resilient while the bond indices in both Europe and the US bounced back from its March lows in line with equity benchmarks.

DISCLAIMER

This document sample has been prepared by ValueAdd Research & Analytics Solutions (“ValueAdd”). This is illustrative and is designed for marketing purposes only.

This document should not be considered as investment advice or a recommendation, or an offer to sell or a solicitation to buy, or an endorsement or recommendation of any company.

The information has been compiled or arrived at from sources believed to be reliable and accurate at the time of this analysis and in good faith. ValueAdd makes no representation or warranty, express or implied as to, nor has it verified, the accuracy, completeness, correctness, and authoritativeness of the information. Accordingly, ValueAdd accepts no liability for any direct or consequential loss or damage arising from (i) the use of this communication, (ii) reliance on any information contained herein, (iii) any error, omission, or inaccuracy in any such information, or (iv) any action resulting therefrom. Authorized recipients should verify the factual accuracy, assumptions, calculations, and completeness of the information.

This document should not be reproduced in any form or distributed (in whole or in part) to any third party without the express prior written permission of ValueAdd.