Global Quarterly Fixed Income Market Performance – Q1 CY2023

Global Quarterly Fixed Income Market Performance – Q1 CY2023

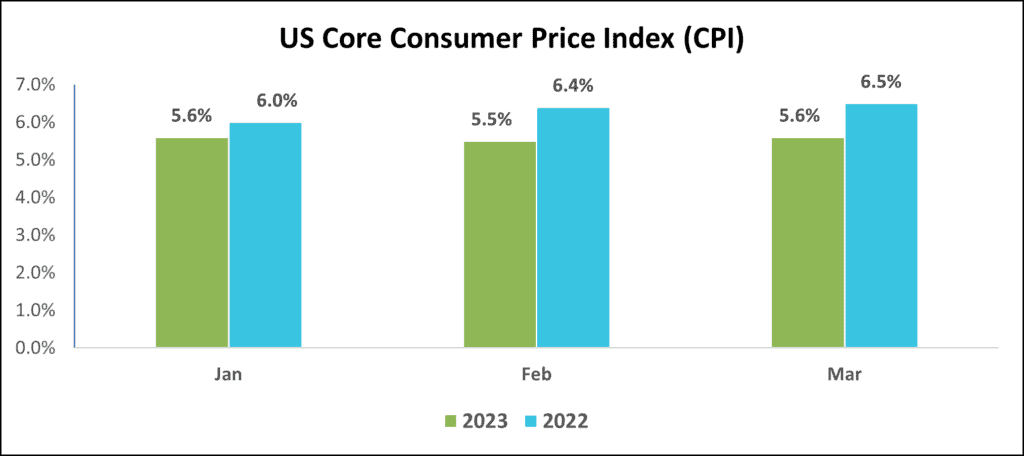

Global fixed-income markets began the year on a stronger footing, considering the lackluster performance exhibited in 2022. China’s easing of COVID-induced restrictions and subsiding of the European energy crisis led to changing sentiments w.r.t. economic growth. Inflation, though lower than the previous year, remained sticky and significantly above central bank targets. Central banks stuck to their hawkish stance, albeit slowing the pace of rate hikes (except for the European Central Bank), as they gauged the impact of seven rounds of rate hikes in 2022 and adopted a cautious stance after the Silicon Valley Bank (SVB)-led banking crisis in March.

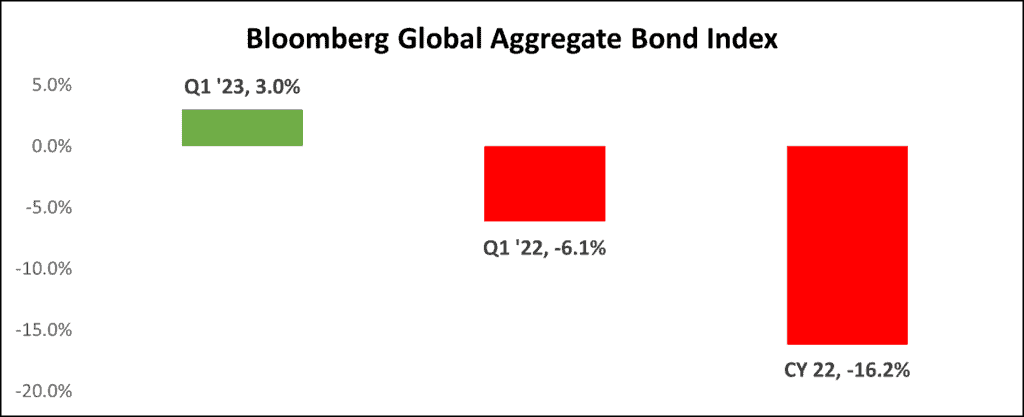

The Bloomberg Global Aggregate Bond Index returned 3% in Q1 ’23, a significant y-o-y improvement as well as relative to CY22. Government bonds saw an uptick after SVB’s collapse, indicating risk aversion coupled with the belief that the pace of monetary policy tightening would decelerate going ahead.

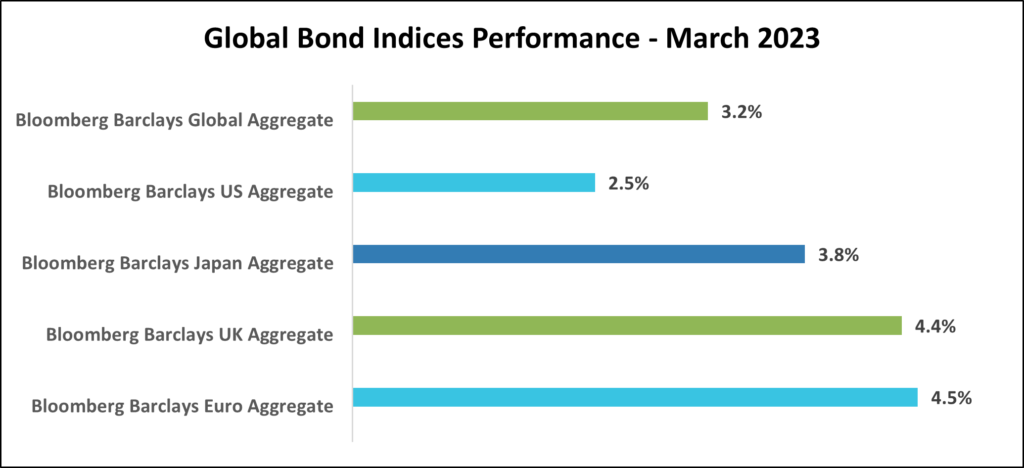

The European market led the global fixed-income pack in terms of total returns, on the back of positive economic data, mainly the abatement of the energy crisis. It was closely followed by the United Kingdom which dodged a technical recession as there was no GDP contraction in Q4 ’22 (as opposed to one in Q3 ’22) contrary to consensus estimates. The outgoing Bank of Japan governor Haruhiko Kuroda left the yield curve control policy unchanged during the January policy meeting, despite an increase in core inflation, which turned bond investor sentiments positive. The Federal Reserve in the US lifted its foot off the monetary policy gas pedal with two rate hikes of only 25 bps during the quarter.

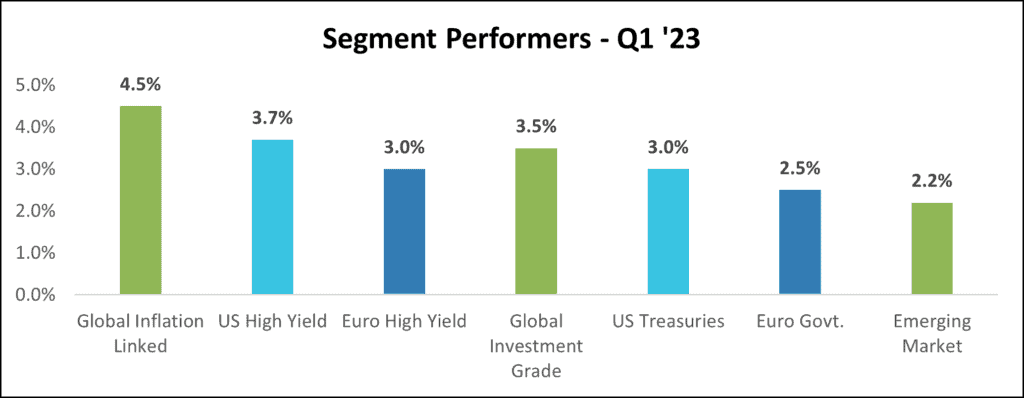

Segment Performers: Inflation-linked Securities Sailed Farthest on Inflation Tailwinds

Inflation-linked securities moved in tandem with the Consumer Price Index (CPI, whose movement is factored by such indices) which hit a 40-year high in 2022. Economic data from China and Europe supported growth theories, and the Federal Reserve and Swiss National Bank’s effective handling of the bank collapse in their respective territories addressed fears of economic contagion, thereby resulting in positive returns across all fixed-income segments. Emerging markets saw a relatively poor performance among segments due to an inflow into equities as a result of positive economic data.

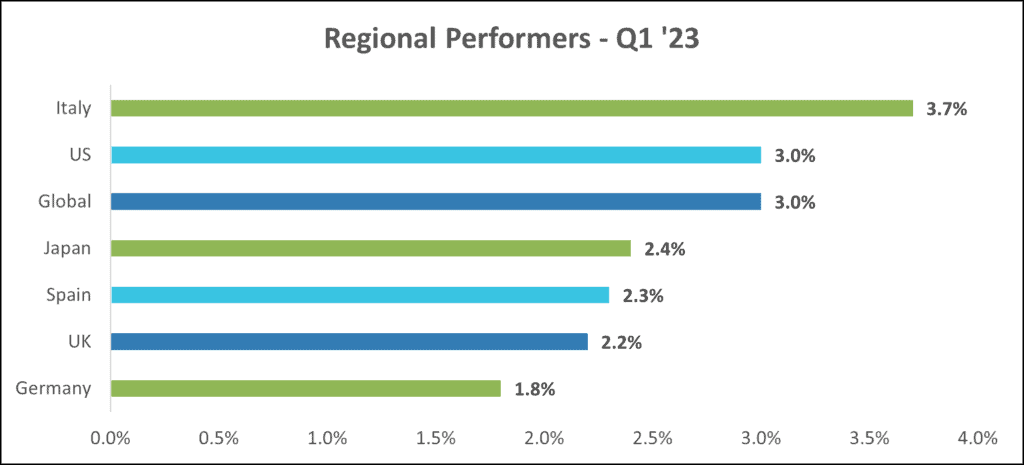

Regional Performers: European Underdog Italy Outshines

A bright economic and political outlook in Italy led to a perception of stability. Credit spreads relative to Germany (the top-rated European fixed-income market) were lower than levels seen during previous instances of market stress. Germany clocked the lowest returns among the top geographies on the back of twin negatives – a rising debt level, which was at its highest since 2015, and the ECB’s tough stance on rate hikes. A slowdown in rate hikes aided US bond performance while the absence of central bank action in Japan and the flight to safety towards government bonds caused Japanese bond yields to fall.

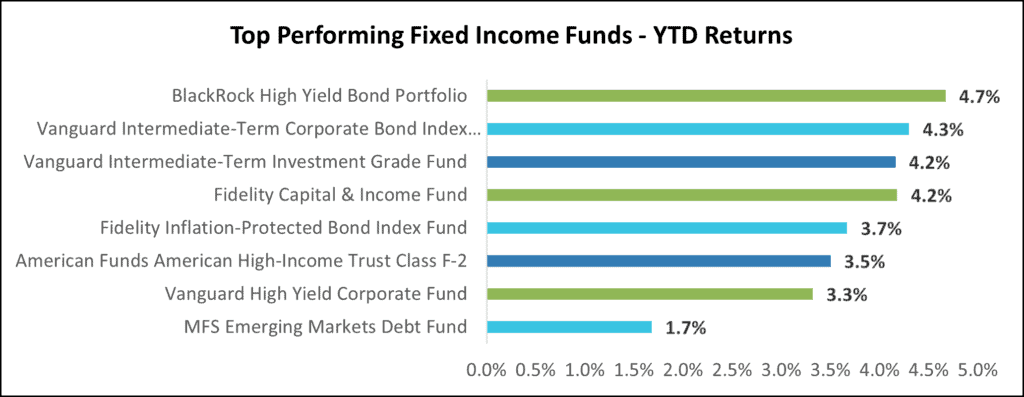

Top-performing Funds: Chasing Yields Armed with Improving Economic Data

BlackRock’s High Yield Bond Portfolio fund clocked the highest returns among fixed-income funds in Q1 ’23. High Yield outperformed investment-grade securities as is generally the norm in an improving economy. Although the SVB-led banking turmoil created risk aversion and caused investors to shun lower-quality instruments, the decline beginning in the 2nd week of March could not offset the increase from Jan 1 to Mar 10. Additionally, the Fed’s quick action in avoiding a spillover onto other sectors instilled confidence.

Outlook

Uniform Expectations Across Geographies with Certain Outliers

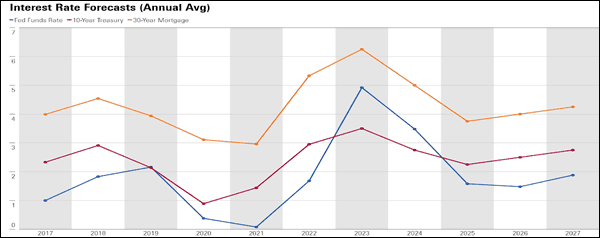

A decrease in oil production and a tight labor market will likely lead to the federal reserve increasing rates by 25 bps in May while a rate hike pause could be seen if there are severe implications on economic growth because of the banking turmoil. With headline inflation taking the route back towards 2%, the ECB is expected to implement lower rate hikes. The probability of a rate hike pause becomes higher if lenders curb credit injection as a response to a turbulent financial sector. Japan, however, will continue with its stimulative stance, with forecasts of inflation weakening going forward.

Bloomberg Economics’ Global Interest Rates gauge is set to peak at 6% in Q3 and thereafter fall to 4.9% by the end of 2024. Moderation of food and energy prices from their peak in the first half of 2022 will provide a fillip to central banks’ rate hike pause decisions across most geographies.

Easing of supply chain constraints in durables, energy, and other key sectors will lead to the Fed pausing rate hikes in 2023 and initiating cuts in 2024.

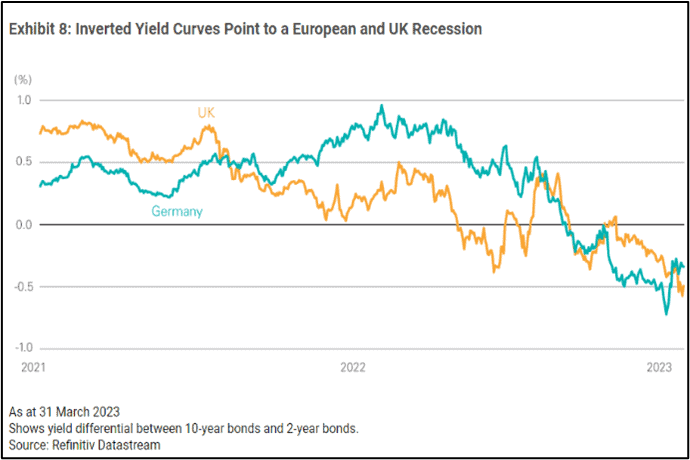

A Looming Recession Will Cap Rising Interest Rates

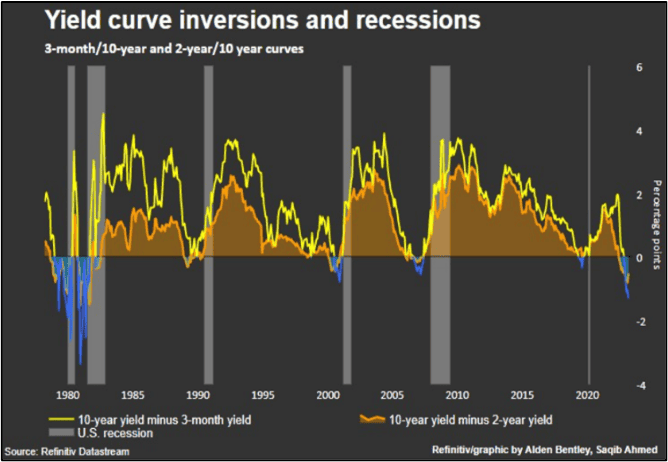

The possibility of a credit crunch and the resulting likelihood of an increase in defaults since SVB’s collapse in early March has led to anticipation of a recession earlier than previously expected, with yield curve inversions backing the probability, although inversions have not always led to a recession.

Source: Lazard Asset Management, Reuters

Emerging Markets Will Likely Have an Edge Over Their Developed Peers

Emerging markets (EM) are expected to witness a deflationary period and a loosening of monetary policy going ahead. Additionally, a peaking US dollar could serve as an added benefit to emerging market debt instruments, and the resilience shown by way of strong fiscal performance in 2022 is likely to continue, leading to significantly lower EM sovereign default rates in 2023.

Risk Aversion Is Set to Remain as Uncertainty Persists

Lenders across geographies have pressed the brakes on lending and are faced with stricter regulatory mandates since the SVB-led crisis. Considering the uncertainty surrounding the likely increase in default rates, investors’ probability to shun risk and embrace the safety of government and investment-grade securities seems higher.

DISCLAIMER

This document sample has been prepared by ValueAdd Research & Analytics Solutions (“ValueAdd”). This is illustrative and is designed for the purpose of evaluating ValueAdd’s research and analytics capabilities only.

This document should not be considered as an investment advice or a recommendation, or an offer to sell or a solicitation to buy, or an endorsement or recommendation of any company.

The information has been compiled or arrived at from sources believed to be reliable and accurate at the time of this analysis and in good faith. ValueAdd makes no representation or warranty, express or implied as to, nor has it verified, the accuracy, completeness, correctness, and authoritativeness of the information. Accordingly, ValueAdd accepts no liability for any direct or consequential loss or damage arising from (i) the use of this communication, (ii) reliance on any Information contained herein, (iii) any error, omission, or inaccuracy in any such Information, or (iv) any action resulting therefrom. Authorized recipients should verify the factual accuracy, assumptions, calculations, and completeness of the information.

This document should not be reproduced in any form or distributed (in whole or in part) to any third party without the express prior written permission of ValueAdd.