Global Quarterly Equity Market Performance – 1QCY2023

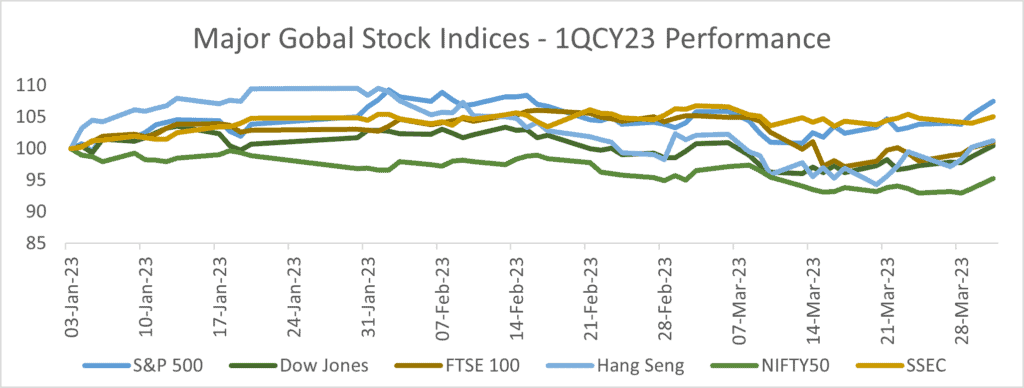

Global equities saw an upward trend in Q1CY23 following a severe beating in CY22. CY22 was characterized by geopolitical turmoil in the form of the Russia-Ukraine war, unprecedented commodity inflation, and hawkish monetary policy actions globally, all of which led to heightened volatility in the global equity markets. MSCI ACWI index fell by 20.0% YoY in CY22, its worst performance since 2008. Entering CY23, volatility and caution continued in the face of the fragility of the banking systems in the US and Europe, persistent inflationary pressures, and recessionary fears. However, the uptick seen in the equity markets towards the end of CY22 persisted in 1QCY23, driven by expectations that the interest rate cycle would peak in CY23, increased economic activity from the re-opening of China, and easing of supply chains and commodity costs pressures.

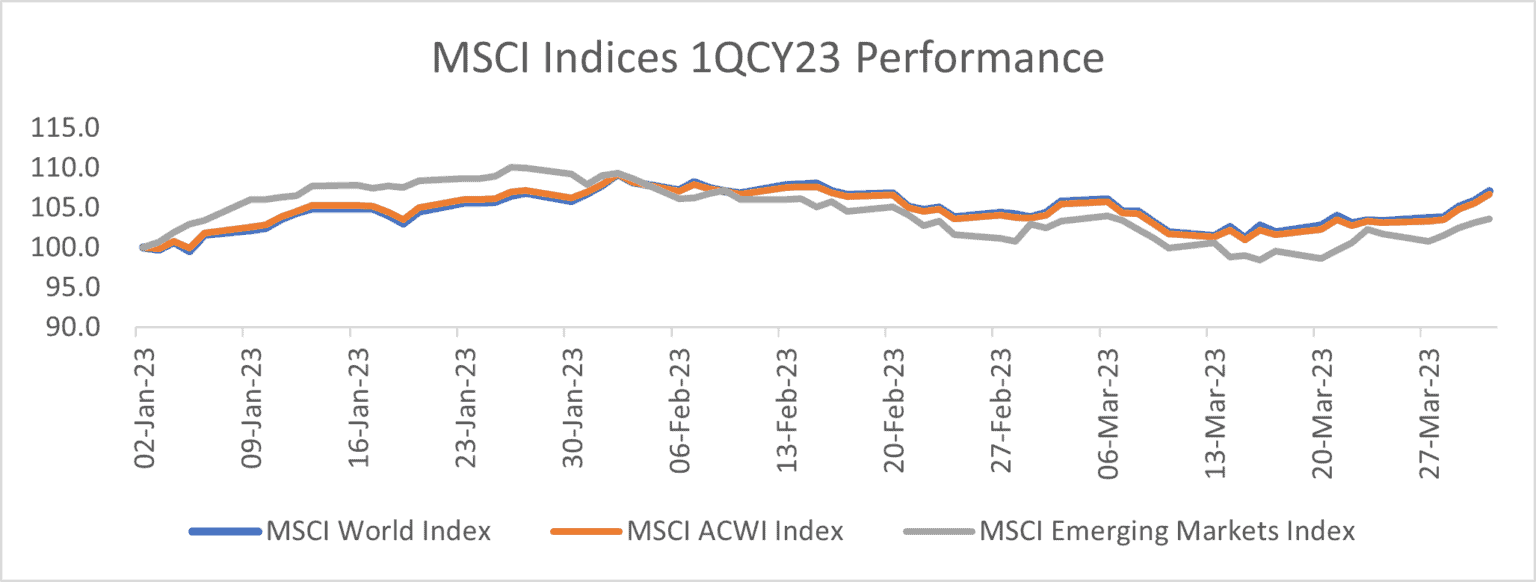

The MSCI ACWI Index (2,888 constituents in 11 sectors across 23 Developed Markets (DM) and 24 Emerging Markets (EM)) saw an improvement in performance at +6.7% YoY (price returns) in 1QCY23, after a sharp fall of -20.0% YoY in CY22. The uptick in 1QCY23 was led by DMs while the recovery in EMs has lagged. The MSCI World Index (1,509 constituents across 23 DMs) saw its performance improve in 1QCY23 at +7.1% YoY compared to -19.7% in CY22. MSCI Emerging Markets Index (1,379 constituents across 24 EM countries) saw price returns of +3.6% YoY in 1QCY23 compared to -22.5% in CY22.

Rowing through turbulent tides:

- Inflation shows signs of peaking – According to Euromonitor, inflation in the largest DMs and EMs is possibly peaking due to slower economic growth and moderating demand. Lower energy prices, commodity costs softening, and the effect of monetary policy tightening are expected to aid in lowering inflation globally. Inflationary pressures in EMs could persist due to adverse FX rates and lower FX reserves. As per IMF’s World Economic Outlook, global inflation is estimated to decline to 7.0% in CY23 from 8.7% in CY22.

- Interest rates continue to rise in the US, peak expected this year – To curb inflation, the Federal Reserve further raised interest rates twice in 1QCY23, by 25 bps each time to reach a range of 4.75% to 5.00%, in addition to tightening of 425 bps last year. The US inflation rate in March 2023 came in at 5.0%, its lowest level since May 2021, largely led by softening of food and energy prices. While the inflation rate has come down, it remains well above the Fed’s target of 2.0%. The Fed anticipates further tightening, but the extent of the same will be based on broader changes in financial conditions, implications for economic activity, labour markets, and inflation. The Fed expects a mild recession in the second half of CY23, with a recovery over the next 2 years.

- Banking crisis in the US and EU – 1QCY23 was rife with news of turmoil in the banking sector including the collapse of Silicon Valley Bank (SVB), Signature Bank, and the bailout of Credit Suisse. The crisis started when SVB was forced to sell a bond portfolio at a loss, raising concerns about the financial position of the bank. This ultimately led to a run on the deposits of SVB on March 10th leading to the largest bank failure since 2008. This induced panic in the banking industry impacting several other regional banks in the US, one of which was the Signature Bank which was closed by the regulators on March 12th. The problems that were already brewing at Credit Suisse, in addition to a material weakness in its 2022 balance sheet, and panic caused by the SVB collapse led to the UBS Group buying Credit Suisse in a deal brokered by the Swiss Government. According to the Fed, the developments in the banking sector could lead to the tightening of credit conditions for households and businesses and could impact economic activity, hiring, and inflation.

- China re-opening – In the first three months of the year, China’s economy expanded more than estimated as the nation began to relax its harsh Covid controls. According to official data, the gross domestic product (GDP) increased by 4.5% YoY in 1QCY23 vs. 2.9% YoY in 4QCY22, aided by pent-up demand. The retail sector experienced a sharp rebound on a low base as it was the most affected during lockdowns.

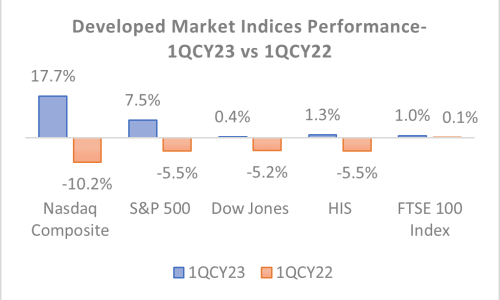

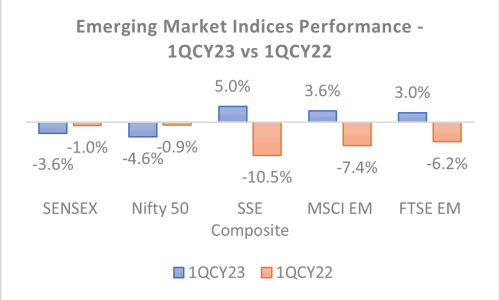

Performance largely improves compared to 1QCY22:

The recovery in performance was seen across major developed and emerging market indices in 1QCY23, except in India. The tech-heavy Nasdaq Composite Index saw a sharp up-move in the quarter as investors favoured the tech sector due to rotation out of the turbulent banking sector and the expectation of interest rates peaking being favourable for the tech sector. The S&P 500 index performance so far in CY23 has mainly been supported by the big gains in tech, consumer services and consumer discretionary while on the other hand financials, energy, healthcare, and utilities pulled the index down. China equities performed well driven by the economy re-opening. India’s relative outperformance seen in CY22 reversed in 1QCY23 and so far Indian indices have lagged compared to other DM and EM indices, led by concerns about growth, delay in rural recovery, and the threat of El Nino to the crucial monsoons.

Source: Bloomberg

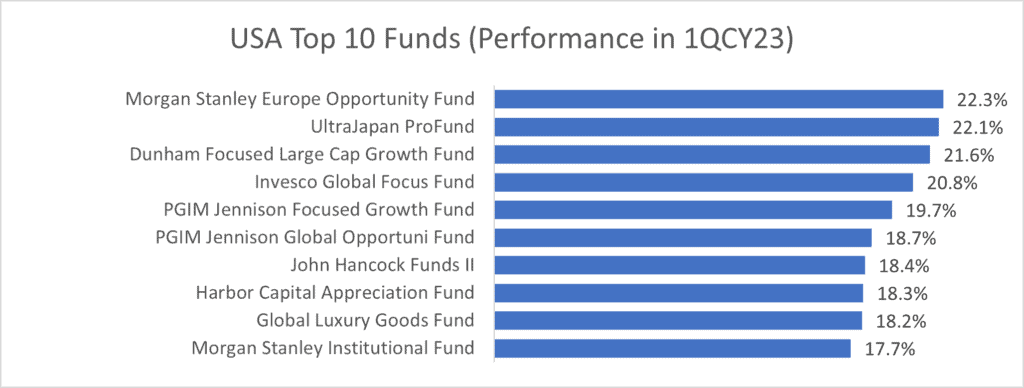

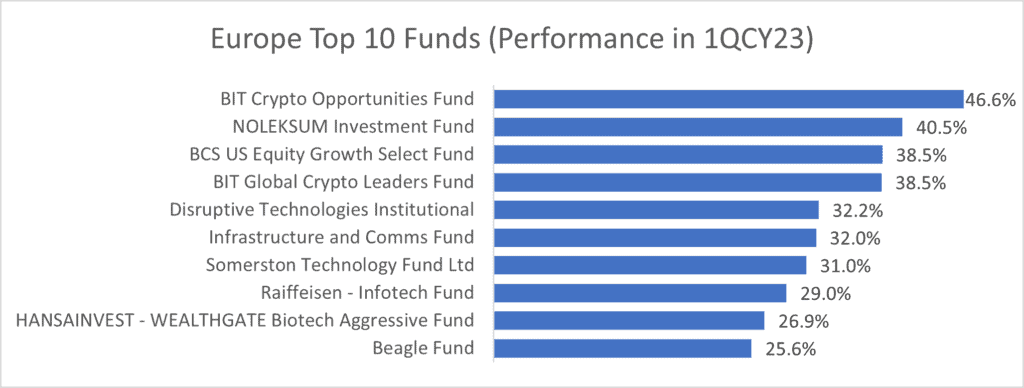

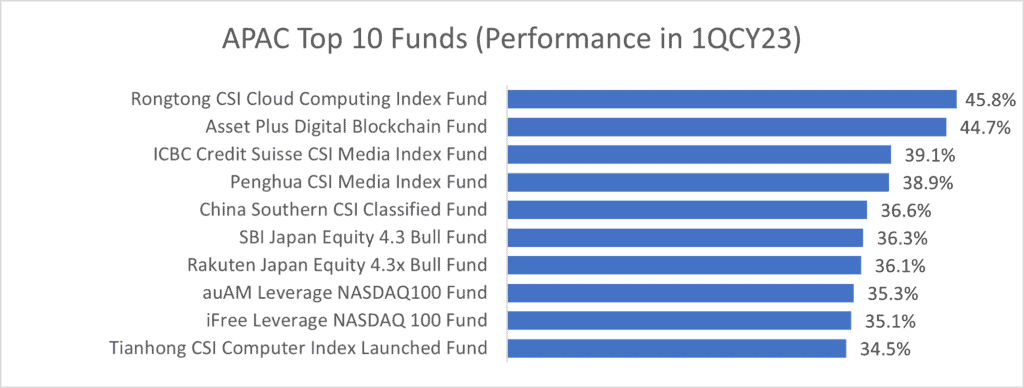

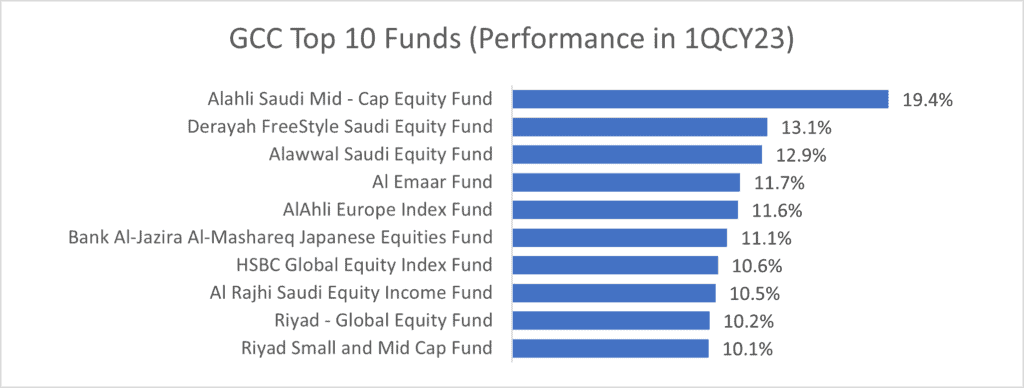

Region-wise Fund Performances:

Region-wise, APAC has seen more funds with better returns followed by Europe. APAC performance was positively influenced by China’s economy re-opening. GCC fund returns have been lagging when compared to the other regions. The key themes across top-performing funds include technology focus, Crypto mining companies. Funds focussing on Japan and Europe have also featured in the top performers.

Source: Bloomberg (Only Open-Ended Funds investing in equities)

Conclusion:

The equity market’s performance in 1QCY23 has been encouraging and factors in an anticipation of the peaking of interest rates in the next few months. A lot depends on the Fed’s monetary policy decisions as on one side the core inflation continues to be sticky and well above the target range, while on the other side, the effects of the rate hikes in the form of the fragility of the banking sector and the possibility of recession have emerged. China will likely be a big contributor to global economic growth, while other large economies face growth concerns. Volatility continues to rock the markets even in CY23, but the early signs of recovery seen in 1QCY23 are encouraging when compared to the severely impacted CY22.